With $fifty two billion in assets beneath custody, Equity Rely on is an established option, however you can probably find reduce expenses in other places.

Contributions to the Roth IRA could be withdrawn at any time, penalty cost-free. When invested thoughtfully and started early, a Roth IRA might be a robust account with a comparatively little First investment.

When you’re looking for a ‘set and neglect’ investing technique, an SDIRA most likely isn’t the proper selection. As you are in whole Command around every single investment produced, It can be up to you to carry out your own research. Try to remember, SDIRA custodians will not be fiduciaries and can't make recommendations about investments.

Usually there are some other expenses you could come upon, which include storage expenses for precious metals and copyright trading fees, Nevertheless they’re fair. There is certainly also a $325 least equilibrium prerequisite.

Our editors are committed to bringing you impartial scores and data. Advertisers never and cannot affect our ratings.

Our March report reveals The three "Robust Obtain" shares that industry-beating analysts predict will outperform over the following year.

The best way to avoid having to pay taxes on IRA withdrawals will be to open up a Roth IRA instead of a standard IRA. Due to the fact a conventional IRA is funded with pre-tax bucks, you have to pay profits taxes on any withdrawals you make, without exception.

Equity Have confidence in is the most effective self-directed IRAs around. It’s an extended-standing self-directed IRA (SDIRA) firm that offers easy account set up and access to a dozen asset courses to take a position in.

Bankrate.com is definitely an impartial, marketing-supported publisher and comparison company. We are compensated in exchange for placement of sponsored items and services, or by you clicking on specific inbound links posted on our web site. Hence, this compensation may well effects how, wherever and in what order goods seem in listing groups, apart from wherever prohibited by law for our home loan, house equity and also other household lending products. Other components, for instance our personal proprietary website principles and no matter whether a product is offered in your area or at your self-chosen credit rating score variety, may also influence how and where by products and solutions seem on This web site. While we try to deliver a wide range of features, Bankrate does not involve details about just about every economical or credit history goods and services.

Your Roth IRA can be equally as safe for a financial institution account. The soundness of the Roth IRA relies on the way you’re investing it. Roth IRAs are an investment with a long time horizon, so investing in anything with fantastic long run returns like an S&P five hundred index fund can have ups and downs but is probably going to give you a wealthy retirement with rather modest contributions.

Simply trusting the corporation you're working with to generally be clear isn’t check over here adequate as click to read you'll find much less guidelines preserving you if they aren’t.

Rocket Dollar permits you to put money into Nearly just about anything. With in excess of 50 companions from which to choose and the chance to convey your own private specials in to the account, it is one of the best alternative investment IRA platforms all around.

The distinctions among a Roth IRA vs conventional IRA primarily come down any time you pay out taxes on contributions and withdrawals.

This technique allows steer clear of any possible tax implications Which may crop up from obtaining a distribution Check out.

Ashley Johnson Then & Now!

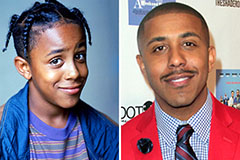

Ashley Johnson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!